|

|

Click on the image to access the Information System |

Camões, I.P. makes available the Integrated Information System for Portuguese Cooperation.

It is an online database that provides information on Official Development Assistance (ODA) both in aggregate terms / Global Data and by project. The data is available both in Portuguese and in English, in €uros and US dollars, for a certain time period.

In the light of the good practices (both national and international) regarding transparency, accountability and communication, of the DAC Main Findings and Recommendations to Portugal and, of the several commitments that Portugal has been undertaking in this field, this new system stands as an important "result” within the progresses made so far.

Main Features of Portuguese ODA 2020-2024

|

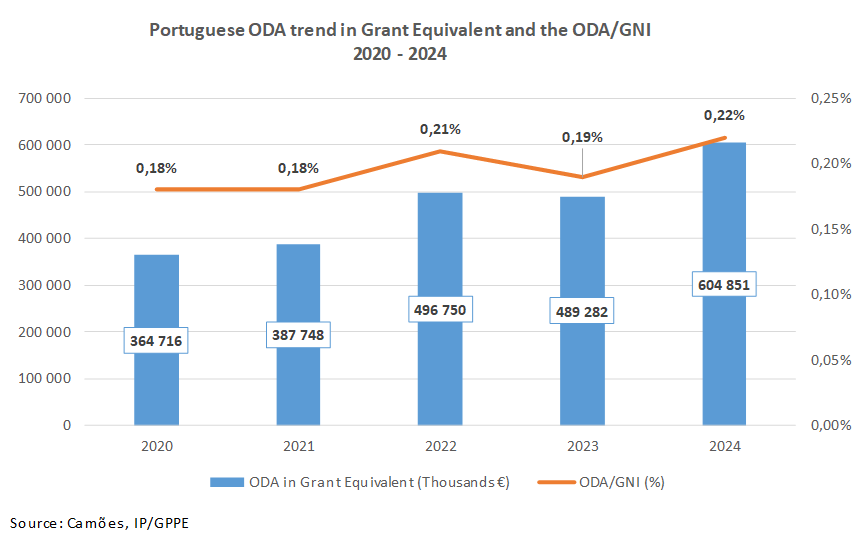

Methodological Note As of 2019 (2018 flows), ODA is now calculated using the Grant Equivalent (GE) system, based on which the ODA/GNI ratio is now measured. ODA also continues to be calculated, reported and published in the old system - Cash Flow (CF). The GE accounts for loans differently from the CF. In the CF system, the face value of the loans was counted as ODA, once the applicable eligibility conditions were met. In the GE system, only the concessional component/value of the loans can count as ODA, thus measuring the real "effort" of the donor in granting them and the benefit to the partner country. In grant equivalent, the grant component of gross disbursements is recorded, the repayments are no longer weighted in the ODA calculation. The difference between Cash Flow ODA (net ODA),and Grant Equivalent ODA (gross ODA) is explained by the fact that the GE accounting method does not take loan repayments into account, unlike the CF method, which accounts for repayments as negative ODA. Thus, GE ODA takes gross disbursements into account, while CF ODA takes net disbursements into account, subtracting the amounts received = repayments. Gross ODA = total amounts disbursed.

Net ODA = total amounts disbursed (gross) minus amounts received (reimbursements).

|

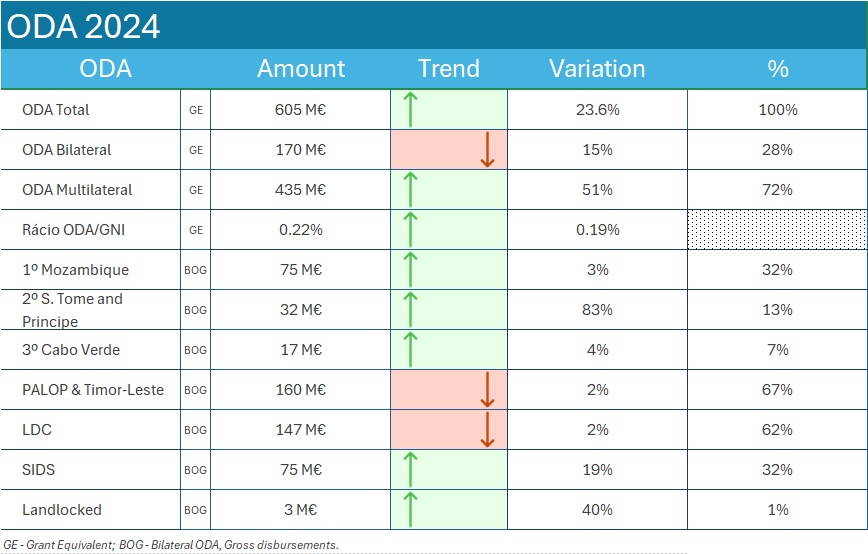

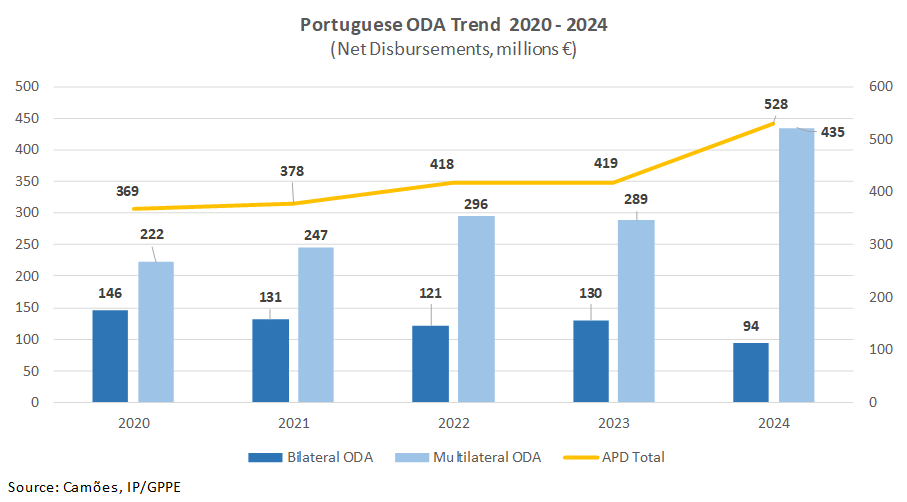

Volume and ODA trends

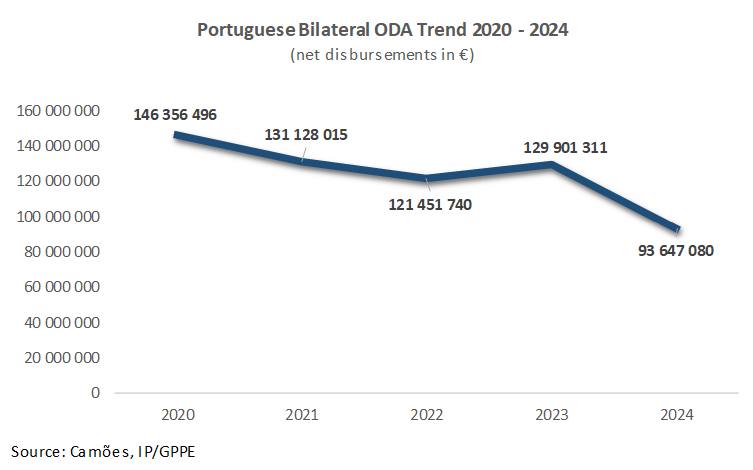

Portuguese ODA has been on an upward trend since 2018 (329M€) and consolidated in 2024 (528M€) - net disbursements.

The ODA/GNI ratio has fluctuated between 0.17% and 0.21% in 2022. In 2023, the ratio fell to 0.19%, but in 2024, it rose again to 0.22%, the largest increase since 2013. In 2024, Portugal ranked 22nd among all DAC donor countries in terms of percentage of GNI. It is also one of the seven European Union member states to increase its ODA.

Portugal's bilateral ODA is largely focused on Portuguese-speaking countries in Africa and Timor-Leste. Multilateral ODA is gradually gaining in importance, mainly because of increased contributions to the European Union's (EU) development aid mechanisms.

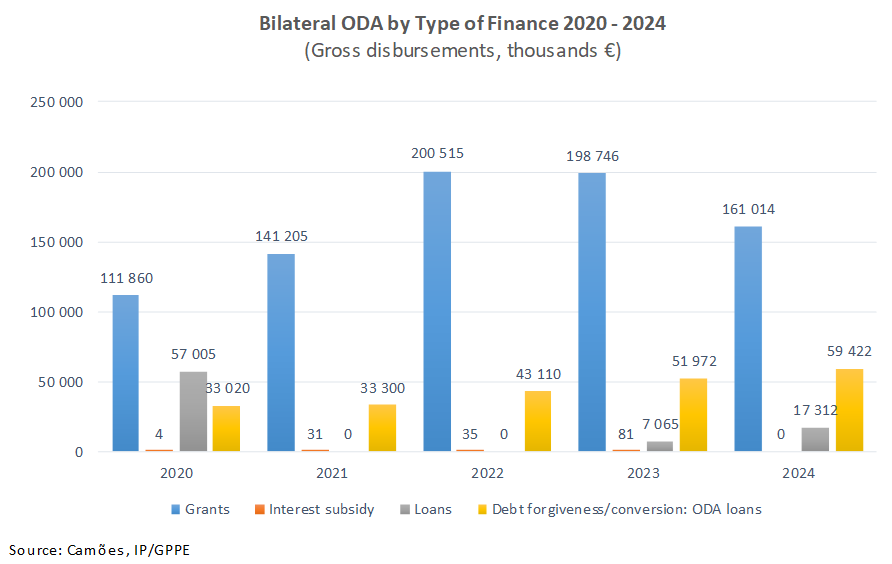

The type of finance, characterized in the past by concessional loans to partner countries, especially in 2011 and 2012, has changed since 2015 to an ODA predominantly based on grants. This is due not only to the lower use of concessional loans by partner countries, but also to the start of the repayment phase for loans granted in the past.

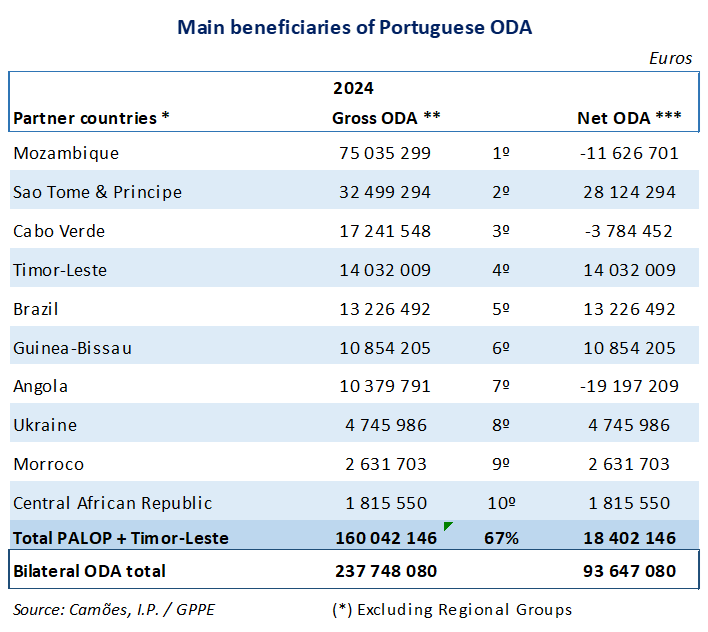

Bilateral ODA - Geographical Priorities

Bilateral ODA is mainly focused on the PALOP countries and Timor-Leste (67%, 160M€, gross amounts). In 2024, ODA to least developed countries (LDCs) will exceed the DAC donor average (22%). This year, 62% (147M€) of gross bilateral ODA went to this group of low-income, highly vulnerable countries facing serious structural obstacles to sustainable development. Portugal also allocated 32% of gross bilateral ODA to small island developing states (SIDS).

In 2024, Mozambique, Sao Tome and Principe, and Cabo Verde are the main beneficiaries.

Bilateral ODA - Sectoral Priorities

Portugal's commitment to the social goals of the 2030 Agenda has resulted in the largest share of sectoral ODA being allocated to the “Social Infrastructure and Services” grouping (Education, Health, Population and Reproductive Health, Water and Sanitation, Government and Civil Society, Other Social Infrastructure and Services), which has concentrated an average of 86% of bilateral ODA in recent years.

The “Non-Sector Allocable” group, which includes general categories such as program aid, debt-related actions, humanitarian assistance or aid for refugees, represents 9%, because of the use of concessional loans by some partner countries, but also due to the increase in support for refugees and humanitarian aid.

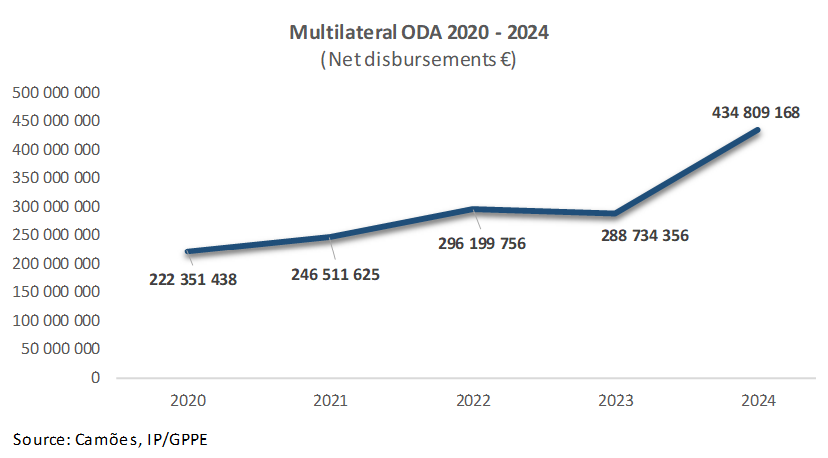

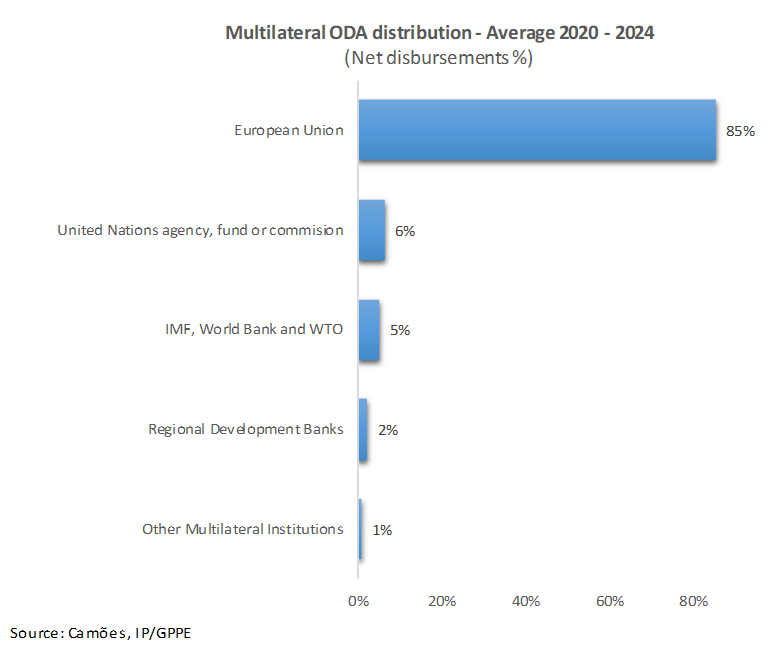

Multilateral ODA

The multilateral component of ODA is gradually gaining weight (69% in 2023, 82% in 2024, net amounts), related to Portugal's increased contribution to the aid mechanisms of the European Union, United Nations, World Bank and Regional Development Banks.

Main recipients of Portuguese ODA